unemployment tax break refund update september 2021

IRS Unemployment Tax Refund 10 September 2021 IRS unemployment tax refund 2021. 24 and runs through April 18.

Tax Refund Stimulus Help I Just Received My Ddd And The Irs Changed It To Sent On Thanksgiving Day But I Never Received Anything And Also Am Wondering When I

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are. You had to qualify for the exclusion with a modified adjusted gross income of less than 150000.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Not only will jobless workers be entitled to a 300 weekly unemployment boost through early September but theyll also get a nice break on their taxes. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. A tax break isnt available on 2021 unemployment benefits unlike aid. The unemployment refund is a refund for those that overpaid taxes on their 2020 unemployment.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. The tax company mentioned changes could be made all through. In july of 2021 the irs announced that.

Unemployment Income Rules For Tax Year 2021. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

Tax season started Jan. To qualify for this exclusion your tax year 2020 adjusted gross. Congress hasnt passed a law offering.

Unemployment tax breakIRS tax refunds. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Unemployment tax break refund update september 2021.

In the latest batch of refunds announced in November however the average was 1189. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. 1 You will get an additional federal income tax refund for the unemployment exclusion.

By Baby Shower September 25 2021. The act excluded up to 10200 in 2020 taxable unemployment income meaning millions of taxpayers were due refunds. Check For The Latest Updates And Resources Throughout The Tax Season.

In the latest batch of refunds announced in November however the average was 1189. People who received unemployment benefits last year and filed tax. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the american rescue plan act of 2021. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return. Tax refunds on unemployment benefits to start in May.

Unemployment tax refund update. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

Unemployment tax break refund update september 2021. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

Fourth Stimulus Check And Child Tax Credit Summary 2 August 2021 As Usa

Child Tax Credit Schedule 8812 H R Block

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Tax Exclusion Expanded To More Taxpayers Nstp

8 5 Million Tax Refunds Have Yet To Be Sent What To Do If You Haven T Received Yours Gobankingrates

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Thousands Of Maryland Homeowners To Receive Property Tax Credit Refunds By September

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Child Tax Credit December Last Ctc Payments Delivered Today Marca

Q A The 10 200 Unemployment Tax Break Abip

Stimulus Updates To Know For Spring 2022 Gobankingrates

Some Americans Won T Get Their Stimulus Checks Until They File Their 2020 Taxes The Washington Post

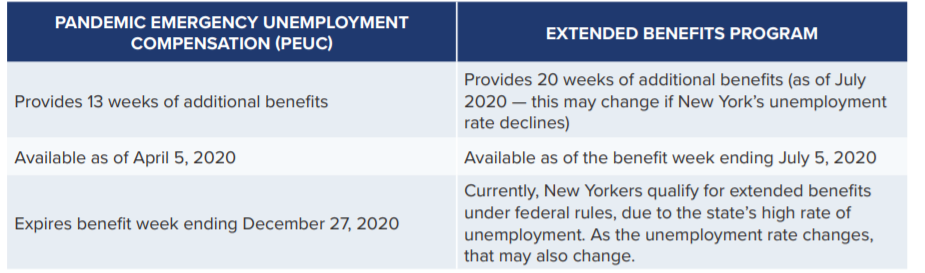

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

How Does Unemployment Affect My Taxes Personal Capital